Can crypto contagion infect mainstream finance?

The crypto carnage has 1 silver lining: the broader fiscal procedure has been spared.

From Brussels to Washington, finance watchdogs downplay the possibility of turmoil spilling into other markets and argue that their possess steps have safeguarded banks from the crypto tailspin.

“This contagion did not prolong into the standard banking and finance sector,” the performing US comptroller of the currency Michael Hsu told the Fiscal Moments.

“This is thanks, at least in part, to federal bank regulators’ continued and intentional emphasis on safety, soundness and purchaser defense,” he explained.

On Thursday, international regulators in Basel went additional — proposing more durable principles to cap crypto publicity at 1 for each cent of a bank’s property.

The Federal Reserve, which just lately unveiled the final results of its annual strain assessments demonstrating the greatest US banks could endure a lot more than $600bn in losses and even now exceed government-mandated capital ranges, sees limited lender publicity to crypto marketplaces, in accordance to Fed officers.

Outside the house the banking sector, firewalls consist of expenditure tips for institutional investors that restrict their publicity to digital property, mentioned an formal at the Securities and Exchange Fee.

The official extra there ended up no signs the crypto sell-off had induced a dash for hard cash from investors trying to get redemptions of standard securities to go over losses in crypto, while the SEC was continue to monitoring this exercise.

“For mainstream asset supervisors, the direct influence of the crypto provide-off is very negligible,” explained Anne Richards, chief govt of Fidelity Worldwide. “Bitcoin designed its way into a little amount of institutional portfolios but for most teams it’s even now extremely a lot on the fringes.”

Andrea Enria, the European Central Bank’s prime banking supervisor, told a European Parliament committee on Thursday there have been “still really limited” connections in between crypto and banks.

“But I discover elevated desire by the banking companies to it’s possible enter these markets as they see younger populations potentially extremely interested . . . I also see, in standard, higher instability in the sector so the faster we can control and give very clear advice, the superior.”

Paschal Donohoe, Irish finance minister and president of the eurogroup of finance ministers, said officials were not concerned at the instant, but added: “I can visualize that in a year’s time we will be as centered on cryptocurrencies as we are on local weather possibility, which is among our best concerns.”

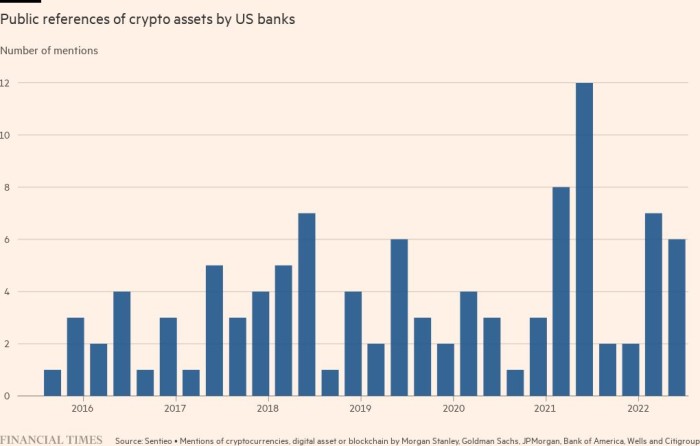

Significant regulated banking institutions have found approaches to provide crypto products to shoppers. Jamie Dimon’s JPMorgan Chase allows crypto exchanges Coinbase and Gemini with deposit and withdrawal transactions Goldman Sachs has bought derivatives joined to bitcoin although also generating a loan to Coinbase secured from bitcoin and lots of banks give rich buyers obtain to crypto financial commitment cash.

More compact US creditors have ploughed far more deeply into crypto, courting electronic asset clients these as stablecoin issuers, crypto exchanges and traders. These incorporate Signature Financial institution, which has claimed much more than a quarter of its about $120bn in dollar deposits is relevant to digital asset clients, and Silvergate, which derived just about all of its $29bn in deposits from electronic asset consumers.

Cautious of diving in far too deep, banking companies have missed out on a lot more than 95 per cent of the $4bn-$5bn in estimated revenues for corporate and institutional clients produced in 2021 through digital assets, in accordance to a report by Morgan Stanley and Oliver Wyman.

“Banks do have to go in which the clients want them to go, so experienced there been buyer stress they may have engaged in a lot more [crypto] activity,” claimed Mitch Eitel, taking care of associate of the fiscal solutions group at Sullivan & Cromwell.

In the absence of banking companies, dedicated crypto loan companies have stepped in for lending. These corporations ordinarily slide in two buckets: decentralised lenders these types of as Aave where financing activity is tracked on its blockchain, and centralised lenders this sort of as BlockFi and Nexo.

Small immediate publicity to financial institutions would make it significantly less probable for them to act as a transmission channel for economical strain from the crypto crash as they did in 2008, according to Clifford Opportunity husband or wife Jeff Berman.

“Banks really don’t maintain crypto and they’ve been pretty watchful about lending towards crypto. And in actuality most of the lending against crypto has been carried out by crypto experts. So the total exposure to crypto is reduced,” Berman reported.

Crypto hedge fund insiders also look calm about the extent to which this could have an impact on conventional bank key brokers and the wider monetary method.

For the reason that most of the regular financial institution key brokers that services mainstream hedge cash have yet to enter the crypto sector, crypto resources are inclined to use specialist digital asset brokers, even though they may nevertheless often use banking institutions when they trade more mainstream assets. This is observed as restricting the probable for banking companies to run up large losses when a fund blows up.

“I do not see this spilling in excess of into the conventional finance earth,” stated Edouard Hindi, main expenditure officer at electronic asset manager Tyr Capital. “The chance [of contagion] that exists in classic finance does not exist in crypto.”

Meanwhile, several massive macro and quantitative hedge funds that have begun investing crypto have accomplished so employing futures, for instance on the Chicago Mercantile Exchange, alternatively than the fundamental cryptocurrencies on their own.

If they had been to undergo losses on these positions they would “have experienced to write-up extra margin with the CME or just take cash losses with the DeFi exchanges”, reported Usman Ahmad, main government of Zodia Marketplaces, a digital asset investing location owned by Normal Chartered.

Neither of these need to effect financial institution primary brokers until people losses mean that the fund is unable to fulfill margin calls at banks that act as brokers for the fund’s other belongings, he additional.

All this has led some Wall Road heavyweights to presently arrive to the summary that the crypto mess does not pose a systemic hazard to banking institutions.

“I really do not consider it’s big adequate to be systemic,” stated Howard Marks, co-founder and co-chair of Oaktree Funds Management. “For a little something to have systemic effect I believe it has to be component of the program and the institutions.”

Calming statements by regulators have not generally been prescient, notably in the operate-up to the 2008 subprime housing crisis when federal government officials played down pitfalls. And not everyone is reassured this time.

“I feel the systemic contagion possibility from a crypto crash is genuine, nevertheless it is really hard to know for guaranteed just how deeply intertwined the electronic currencies are with hedge cash and other classic money corporations,” said David Trainer, main executive at investment decision study agency New Constructs.

“As the advertising carries on, we soon will uncover out just how substantially systemic risk there is.”

By Joshua Franklin in New York, Stefania Palma in Washington, Laura Noonan in Brussels and Scott Chipolina, Laurence Fletcher, Harriet Agnew and Owen Walker in London