Horizon Technology Finance Stock: A High Quality, 10.4% Yielding Tech-Focused BDC (HRZN)

nespix/iStock by means of Getty Illustrations or photos

Horizon Technological innovation Finance Company (NASDAQ:HRZN) experienced a 24% valuation lower in 2022, and the small business enhancement corporation is now worth shopping for at guide benefit.

Horizon Technologies Finance is a superior-yielding, technological know-how-concentrated BDC with a generate that lately surpassed 10%. To aid its expansion, the small business progress organization has a secured, credit card debt-oriented expense portfolio.

Horizon Technologies Finance’s credit score portfolio is executing properly, and the inventory could sooner or later trade at a bigger ebook benefit a number of.

An additional Gem In the BDC Sector

Organization development providers have endured important valuation losses in 2022, owing to investors’ expectation that recession components will have an affect on the sector’s potential clients for reserve worth development.

For the duration of recessions, it is a lot more complicated for enterprise improvement companies to make good progress in essential metrics this sort of as web investment revenue (owing to portfolio cash flow force) and reserve price (due to stress on credit score quality which tends to improve in the course of recessions).

With that mentioned, I believe it is time for dividend traders to concentrate on BDCs that, because of to their credit history performance and floating rate publicity, have the likely to outperform the sector.

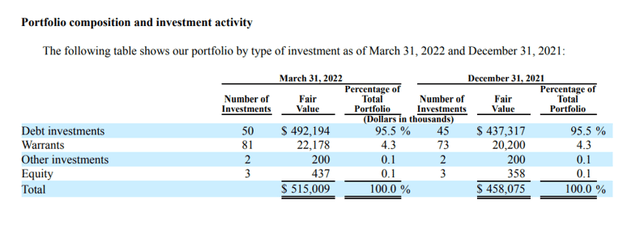

Horizon Technological know-how Finance is a month to month-having to pay specialty finance company with a rapidly expanding investment portfolio. The portfolio experienced 50 personal debt investments and 81 warrant positions as of March 31, 2022.

Financial debt investments built by the BDC are usually Senior Phrase Financial loans that deliver the BDC with a superior level of money safety. In March, the firm’s personal debt, warrant, and fairness positions were valued at $515 million, and the BDC was invested at a 12.4% annualized common portfolio generate.

Portfolio Composition (Horizon Know-how Finance)

Horizon Technologies Finance is an attention-grabbing dividend expenditure because it mostly invests in progress-phase firms in the technologies, existence science, healthcare facts, and companies industries, and it participates in the upside of people firms through equity and warrant positions.

Horizon Technologies Finance is comparable in several strategies to Hercules Capital, yet another BDC that seeks to capitalize on equity upside in distinct technology niches.

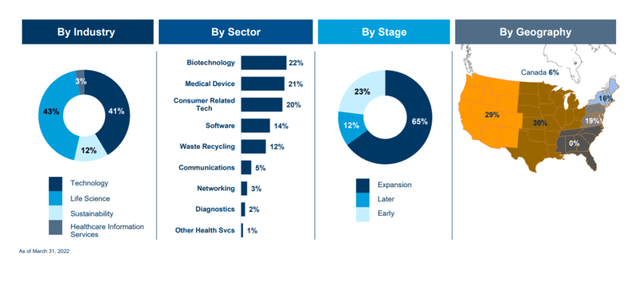

Horizon Know-how Finance has developed and nurtured a technologies-aim in venture funds, which is where by the BDC sees the best possibility for large returns. The BDC is very well-diversified and steers very clear of cyclical industries that pose earnings and cash circulation challenges. Biotechnology as an field accounts for 22% of the BDC’s whole field publicity.

Investments Overview (Horizon Know-how Finance)

NII Exceeds Distributions

Horizon Technology Finance’s portfolio produced $1.41 per share in internet financial investment income in 2021, when BDC paid out $1.25 for every share, implying an 89% pay-out ratio. The dividend pay back-out ratio was 90% from 2019 to 2021, so investors can reasonably assume that the $.10 per share regular monthly dividend is sustainable.

Sail Via The Next Desire Level Mountaineering Cycle With Horizon Technologies Finance

The central bank is aggressively increasing rates, producing now an fantastic time to decide on BDCs with the biggest total of floating fee publicity.

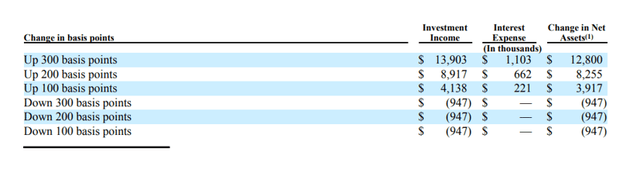

Horizon Engineering Finance structures its finance bargains very carefully to make sure 100% floating amount publicity, which indicates HRZN has extra floating rate exposure than the average enterprise growth enterprise in the sector.

This implies that a considerable maximize in desire prices will advantage Horizon Technological innovation Finance much more than other BDCs. Dependent on the BDC’s curiosity sensitivity desk, a 200-basis-stage maximize in interest costs is expected to result in a $8.26 million raise in Horizon Know-how Finance’s net assets.

Interest Sensitivity (Horizon Technologies Finance)

Buying and selling At Reserve Value

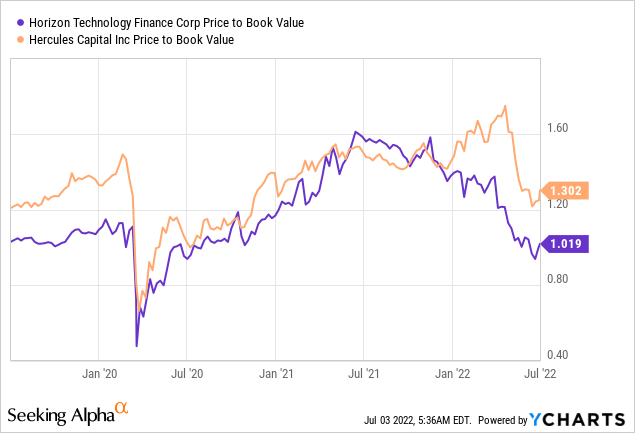

For the reason that of their similarities in specific industries and deal structures, I consider Hercules Funds is the most effective comparable for Horizon Know-how Finance. Hercules Funds has a P/B ratio of 1.3x, owing to the BDC’s enormous success with its tech-targeted investment method that combines fascination payments with fairness upside.

Because the market place rewards HTGC for the consistency of its portfolio benefits, the BDC trades at a premium to e book value. Horizon Engineering Finance at this time has a P/B ratio of 1.0x, implying that HRZN may well be a far better get than Hercules Money primarily based exclusively on guide worth.

Are There Any Asset Quality Issues?

Proper now, I you should not see any major problems. Horizon Technologies Finance had one loan that was earlier due as of March 31, 2022. The charge of this expense was $11.9 million, and the honest value was $5.5 million. On a reasonable benefit basis, the non-accrual ratio was about 1%, dependent on the total portfolio worth of $515 million.

Why Horizon Technologies Finance Could See A Reduce Inventory Selling price

To acquire up-to-day information and facts about Horizon Know-how Finance’s portfolio functionality, traders should intently monitor the BDC’s book worth craze and non-accrual ratio. With only a single non-accrual investment decision, I might say portfolio high-quality is strong, but issues can constantly improve for the worse, specifically if the BDC sector is destabilized by a economic downturn.

My Summary

Now that Horizon Engineering Finance is investing at ebook value, the proposition gets to be more captivating.

HRZN is one of the greatest bets in the BDC sector for rising interest prices because it is 100% uncovered to floating fees.

The dividend is included and reasonably protected, even though non-accruals are retained to a minimal.

Horizon Technological know-how Finance is distinguished by its technological emphasis, and equity appreciation benefits in the payment of specific dividends.