Invest locally for good returns – Anchor Capital

[ad_1]

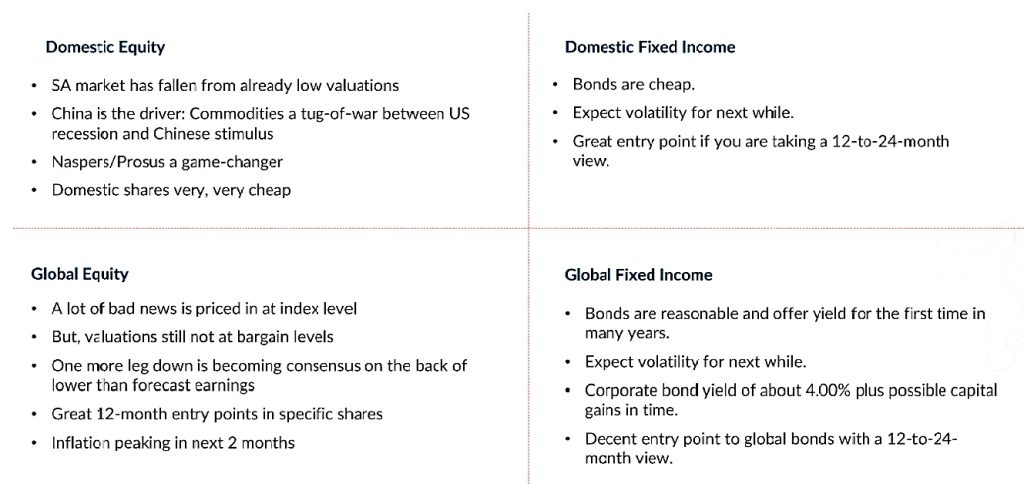

An financial investment in neighborhood shares and bonds is sure to deliver the greatest returns about the upcoming 12 to 24 months, when worldwide equities and international bonds will almost certainly lag the returns the area bourse and bond industry guarantee.

Anchor Cash CEO and co-chief expenditure officer Peter Armitage advised investors in 1 of firm’s common updates on the financial commitment prospective of various asset courses, that they can hope the recent volatility in equity and bond markets to proceed for the rapid future – but that chances abound.

“The prospect is that wonderful results are attainable if it is not as terrible as the planet is speaking,” he states, referring to the seemingly around the globe wave of negativity that has depressed monetary markets to cut price ranges.

“If you glance through the final little bit of achievable downside, the upward trajectory in 12 months’ time is excellent.”

Asset manager Anchor’s investigate into where traders can come across the most effective price now and where by to glimpse for the very best returns more than the following handful of months found that shares of nearby providers are likely to outperform individuals of intercontinental businesses, simply since nearby shares are on lessen rankings than foreign equities. This is particularly true with regards to these ever-well-known US technological innovation shares.

Domestic equities are anticipated to give a return of about 15%, nearby bonds just far more than 10% and income only 5%.

World equities will return only 10%, authorities bonds 3%, global corporate bonds 4.5% and funds invested offshore a pretty minimal 1.5%, in accordance to Anchor.

Bargains

Armitage states the SA equity sector has fallen from by now small valuations, pointing out that the surges in the costs of Naspers and Prosus were being the only noticeable contributors to returns in the 2nd quarter of 2022.

He describes the latest announcements by Naspers and Prosus relating to the sale of Tencent shares and making use of the proceeds to acquire back again Naspers and Prosus shares as “a game changer”.

When Anchor calculated the figures for its exploration, Naspers was buying and selling at a discount of much more than 50% to the price of its underlying investments, generally its financial investment in Tencent.

“Naspers can sell an asset for R100 and obtain it again on the identical working day for R50,” states Armitage.

Anchor calculates that this could add much more than 10% to its net asset worth (NAV) each and every 12 months.

The same goes for Prosus, though the get is not as pronounced, because modern share cost movement has diminished the price reduction to NAV for Prosus to all around 41%.

As a result, even after the sharp leap in Naspers and Prosus, community shares are affordable.

“Domestic shares are pretty, really low-priced,” says Armitage, noting that financial institution shares are trading at eye-catching costs and that a probable restoration in commodity marketplaces could raise resource shares.

Anchor expects that banking shares will return all over 15% above the up coming 12 months, though commodity shares could supply returns in excess of 30%.

Armitage states existing share charges of significant banking companies are reminiscent of a “fire sale”, pointing out that the financial institutions obtained substantial returns on fairness and could go on to improve earnings strongly – nevertheless many shares are sitting on reduced cost-earnings ratios of 6 to 7 occasions, and at the maximum dividend yields viewed in numerous a long time.

SA bonds

Anchor’s head of set profits and co-chief investment decision officer Nolan Wapenaar claims SA governing administration bonds offer you price much too.

“Current concentrations stand for a terrific entry issue if you are taking a 12- to 24-thirty day period watch,” says Wapenaar, while he warns that investors must expect volatility to go on over the following couple months, as investment sentiment is sure to transform supplied the present-day uncertain economic environment.

He factors out that yields on government bonds are at elevated concentrations as buyers appear to be factoring in the worst – the R2030 is now buying and selling at over 11%, the optimum in yrs except for the brief spurt in March 2020 when govt announced strict Covid-19 lockdown actions.

SA bond current market reflects worst-case scenario

Supply: Anchor Money

Global equities

In contrast, Anchor comes to the conclusion that global equities are still a bit on the high priced side, while international bonds offer little worth too.

In the course of a presentation of the research results, Armitage place up graphs of various of the common US shares to demonstrate the audience that some of these shares have declined sharply as they re-rated from beforehand extremely significant ratings to a lot more average valuations, but that rankings nonetheless appear to be really demanding.

Significant tech shares like Apple, Alphabet and Microsoft fell again to pre-Covid-19 stages after the strong growth when investor expectations surged on ‘work, discover and entertain at home’ remaining viewed as the greatest answer to the world’s problems.

Regardless of the relatively large declines, Anchor’s global equity analyst James Bennett states world data technological innovation shares are not in “deep worth territory” – but that investors need to not steer clear of the sector entirely.

“Some tech providers have demonstrated a exceptional skill to mature into what appeared like stretched valuations at the time,” he suggests, hinting that the recent lower scores won’t last without end.

Study: Nasdaq get streak is fueled by tech losers turning into winners

“Tech proceeds to have a spot within a balanced portfolio,” suggests Bennett.

“Tech spending is more and more mission-important for enterprises to develop their earnings. The productive software of contemporary technological know-how is enabling businesses to scale much faster than in common brick-and-mortar companies.

“We think that it would be a mistake to stay away from the sector as a full,” he provides.

“These sorts of provide-offs ordinarily produce great obtaining opportunities in particular person shares and the existing pull-back is unlikely to be any different in this regard.”

Put together for volatility

Anchor warns that investors need to be organized for volatile marketplaces.

“Outside of the challenges we flag on a weekly foundation impacting the South African financial state – this sort of as superior unemployment, Eskom, and corruption – the pressing chance for the JSE and portfolio construction is the inherent dependence of the world-wide commodity cycle keeping up,” suggests Armitage.

“The JSE is intensely dependent on the mining exports. Must we see a deterioration of vital export commodities, it would not only affect our assessment of those corporations with direct exposure, but also affect on the forex and inwardly-focused sectors like financial institutions, coverage, retail and normal industrials.”

Overview of financial commitment choices

Supply: Anchor Funds/Thomson Reuters

[ad_2]

Supply hyperlink