She had a $29,000 loan for a $16,000 car. How auto finance is driving Canadians into debt

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/NUE5SPT4KBFO7KGMGKI5PQXC3U.JPG)

Natasha Hodgkin bought a car in Southwestern Ontario valued at less than $16,000. She ended up with an auto-loan balance of nearly $29,000.Geoff Robins/The Globe and Mail

In September, 2018, Natasha Hodgkin drove off the lot of a used-car dealership in Southwestern Ontario with a 2017 Kia Optima valued at less than $16,000 – and an auto-loan balance of nearly $29,000.

Her car payment amounted to more than $450 a month. Over the life of the loan, which had a term of seven years and an interest rate of nine per cent, she stood to pay more than $38,000 for a second-hand hatchback that, as Ms. Hodgkin’s papers show, turned out to have a persistent hood-latch issue.

Instead, about a year and a half later, Ms. Hodgkin, a Newbury, Ont.-based single mother of two, filed for bankruptcy. While she had accumulated other high-interest debt as she struggled to pay the family’s bills on one income, the auto loan was by far the largest one she discharged in the filing.

“I can’t do these payments any more,” Ms. Hodgkin, 33, who runs the fresh-meat department at a local catering company, remembers thinking at the time. “I’m just barely getting by, barely able to pay everything – you can’t live off scraps.”

While few Canadians default on their auto loans, the story of how Ms. Hodgkin ended up with an auto loan far greater than the value of her car is a common one in Canada. Consumer advocates say it highlights how lax regulation led to an auto-finance boom that’s driving scores of car buyers deep into debt.

At the root of the problem are longer car loans – with terms of six, seven or eight years – and the practice of folding the unpaid balance on an older vehicle into the loan contract to finance a new one.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/O56WZBVHWBC65K273G3PNIL3BM.jpg)

The average transaction for new vehicles in Canada stood at $46,000 in February, up 20 per cent from $35,000 in 2019, according to research firm J.D. Power.David Zalubowski/The Associated Press

Born out of the financial crisis of 2007-08, when lenders stretched out loans beyond the traditional term of five years to shrink payments and stimulate sales, longer auto loans have been as popular as ever during the pandemic. With shortages and supply chain snags driving up the prices of both new and used vehicles, more and more consumers have been signing up for extended loan terms when buying a car.

The average transaction for new vehicles in Canada stood at $46,000 in February, up 20 per cent from $35,000 in 2019, according to research firm J.D. Power. For second-hand vehicles, the average price was $34,600, up 47 per cent compared with a year earlier, according to figures provided by Canadian Black Book.

Why Canada’s soaring inflation is going to cost you more to move

When it comes to zero-emissions vehicles, Canada is pushing the wrong policies

Meanwhile, in 2021, nearly three-quarters of financing for new vehicles had terms longer than five years, with seven-year loans making up 40 per cent of the mix, according to J.D. Power. Seven years is now also the most common term length for used-vehicle loans, the data show.

The appeal of longer auto loans is easy to see. For a set car price and interest rate, a longer repayment period allows buyers to make smaller installments. Similarly, for a set car payment, longer terms may tempt budget-conscious buyers to upgrade to a more expensive vehicle.

But longer terms also mean car owners pay significantly more in interest over the life of the loan. And extended-term loans also come with higher risks tied to negative equity, which occurs when the resale value of a borrower’s current vehicle is less than the outstanding balance on the auto loan.

“When consumers are carrying more negative equity, the probability of loan loss increases, and the size of the potential loss also increases,” the Financial Consumer Agency of Canada, a federal watchdog, noted in a 2016 report on the country’s auto-finance market.

Negative equity – also known as being underwater or upside-down – is common when financing a vehicle. That’s because cars and trucks typically lose value over time, with the steepest drop occurring in the first year and the pace of depreciation slowing down afterward. New vehicles generally shed about a third of their value within 12 months of leaving a dealer’s lot, which makes negative equity in the first two or three years of ownership unavoidable unless you have a big down payment of cash.

But extended-term auto loans mean that borrowers, who are making smaller payments over a prolonged period of time, take longer to get to the point where their loan balance is fully covered by the resale value of their vehicle. While a driver with a five-year loan may reach positive equity in two or three years, someone with an eight-year loan may take fully seven years to get there.

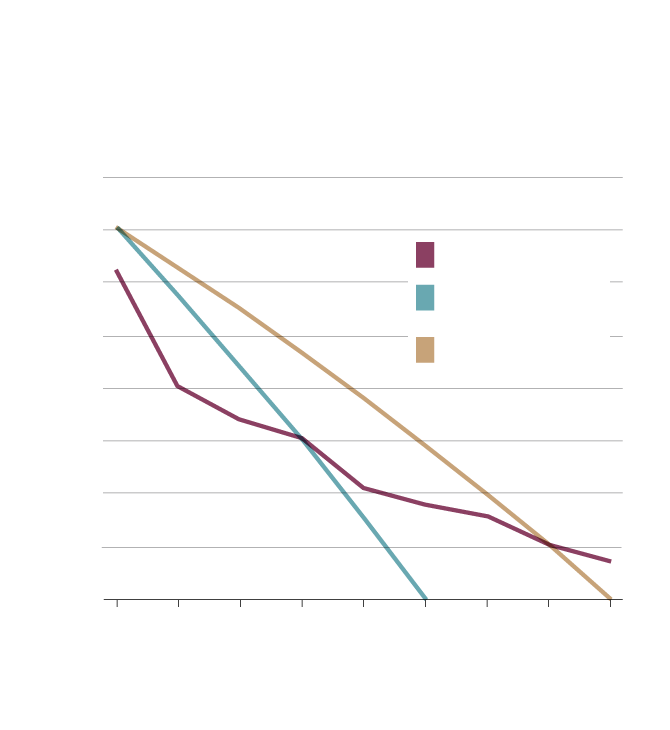

Long-term negative equity

In a standard five-year loan, the consumer would start

accumulating positive equity halfway through the

fourth year. For an eight-year loan, they would not

begin acquiring positive equity until the end of the

seventh year.

the globe and mail, source: financial consumer

agency of canada

Long-term negative equity

In a standard five-year loan, the consumer would start accumu-

lating positive equity halfway through the fourth year. For an

eight-year loan, they would not begin acquiring positive equity

until the end of the seventh year.

the globe and mail, source: financial consumer

agency of canada

Long-term negative equity

In a standard five-year loan, the consumer would start accumulating positive equity halfway through

the fourth year. For an eight-year loan, they would not begin acquiring positive equity until the end of

the seventh year.

the globe and mail, source: financial consumer agency of canada

And the risks of negative equity compound when consumers trade in their cars or trucks before they’ve achieved positive equity. In that scenario, lenders calculate the difference between the outstanding balance on the loans and the assessed resale value of the older vehicle. The leftover debt is then added to the loan for the new vehicle.

That’s what happened to Ms. Hodgkin. The Kia Optima was the second car she’d bought from that Ontario dealership. In September 2017, just a year earlier, Ms. Hodgkin had made her first visit to the used-car seller, looking to replace a 2001 Chevrolet van that had never fully recovered from a coolant leak with a newer vehicle that would reliably get her to work and ferry her kids to school.

The Chevrolet van had been a gift, and Ms. Hodgkin, then 28, had never bought or leased a vehicle before, a fact she said she made clear to the dealership staff. Eventually, she drove off in a 2016 Nissan Versa.

But after just 12 months, Ms. Hodgkin says she went back to the dealership because the car had begun to have mechanical problems. There, she says, staff advised her to trade in the vehicle instead of spending money on repairs. Documents Ms. Hodgkin shared with The Globe and Mail show the trade-in value of the Nissan, on which Ms. Hodgkin owed $18,100, was just $9,500. This left Ms. Hodgkin with $8,600 in negative equity, which was added to the loan for the Kia, which the dealer was selling for $15,826. After factoring in various fees, her loan’s principal amount worked out to just under $29,000.

Although Ms. Hodgkin initialled and signed the document that lays out the terms of the sale, she says she didn’t understand she had negative equity and the dealership staff didn’t explain it.

It wasn’t until she filed for bankruptcy and a licensed insolvency trustee walked her through her auto loan that she says she realized she still owed thousands of dollars on the Nissan.

The dealership said its staff “clearly explained” to Ms. Hodgkin that her Optima purchase included negative equity. Along with the bill of sale, the company said it also provided Ms. Hodgkin with a handout from the Ontario Motor Vehicle Industry Council (OMVIC) that illustrates the risks of trade-ins with negative equity and of extended-term auto loans. (Ms. Hodgkin says she never received the OMVIC leaflet.)

The company also noted the Nissan had elevated mileage when Ms. Hodgkin traded it in, which reduced the resale value of the vehicle and increased the negative equity balance on her Optima loan.

“We pride ourselves on transparency, full disclosure, and adherence to all procedures and regulations required by the banks and lenders with whom we assist our clients to get auto loans through,” the company said via e-mail.

George Iny, president of the Automobile Protection Association, a consumer-advocacy organization, says he often hears from borrowers who say they signed their auto loans at the dealership without fully understanding the conditions of their contract.

While consumers can use a personal line of credit or arrange for financing directly with their financial institution when buying a vehicle, dealers often act as intermediaries between car buyers and lenders, facilitating credit agreements. For the service, they received a commission.

“In general, when consumers buy more car, dealers earn higher reserves for arranging the financing,” the FCAC noted in its report.

Among new-vehicle buyers in Canada who traded in their previous car or truck, 23 per cent had negative equity in 2021, according to J.D. Power. The average negative equity for consumers who were underwater in 2021 was around $5,800, a figure that declined from $6,800 in 2020 as pandemic-linked shortages resulted in higher average retained values for used vehicles.

The cost of negative-equity trade-ins can become crushing for consumers with short credit histories or bruised scores who only qualify for high-interest loans, Mr. Iny noted. Among this group of subprime borrowers, it’s common to see drivers running up $40,000 to $50,000 in debt for compact cars, he said.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/D2MGZ5IHA5KPJJY3XQJZOZJCKI.jpg)

Extended-term auto loans mean that borrowers take longer to get to the point where their loan balance is fully covered by the resale value of their vehicle.Jeff Roberson/The Associated Press

Extended-term, high-interest auto loans are especially onerous for borrowers who live in rural areas where having a car is a necessity of life, said Omar Ha-Redeye, a lawyer at Toronto-based Fleet Street Law.

In Ms. Hodgkin’s case, the negative equity also meant getting rid of the car didn’t erase the debt. Even after surrendering the Kia Optima, she still had an auto-loan balance of nearly $16,000 when she filed for bankruptcy in early 2020, documents show.

“In Ontario, if an individual surrenders an asset like a car, the debtor still has the right to come after them for the shortfall,” said Karen Liberty, a licensed insolvency trustee at MNP Ltd. who assisted Ms. Hodgkin through her bankruptcy filing.

Typically, creditors will add up the loan balance and the costs of repossessing and auctioning off the car, then subtract the proceeds of the sale, Ms. Liberty said. Whatever is left over is still the debtor’s responsibility to pay, she noted.

It wasn’t until the bankruptcy that Ms. Hodgkin was able to freeze and eventually discharge all her creditors, including the car loan.

Ms. Hodgkin’s auto-loan lender, Scotia Dealer Advantage, a subsidiary of Bank of Nova Scotia, said they couldn’t comment on individual customer matters because of privacy concerns.

“We are committed to providing the best possible advice to our customers. Before purchasing a new or used vehicle, it is important to consider a variety of factors and to plan for the full life cycle of the vehicle ownership,” the company said in a statement.

Ms. Liberty said she’s seen auto loans with interests as high as 20 per cent. And, over the past decade, she’s noticed an increase in insolvency filings that include longer-term loans.

Some consumer-law experts worry auto-loan debt could soon become more of a burden for well-qualified, higher-income borrowers as well. Scores of Canadians who moved to the suburbs and smaller communities during the pandemic in search for greater housing affordability are now more dependent on their vehicles, Mr. Ha-Redeye noted.

“This is especially true as employers are pushing for workers to return to the office, which increases further the needs of many Canadians to own a car in order to earn a living,” he said.

Concern over swelling car-related debt has prompted some regulators to tighten rules and oversight.

Under Canada’s new Financial Consumer Protection Framework, which is expected to come into force at the end of June, banks and their subsidiaries will have to ensure the products and services they sell, including auto loans, meet their customers needs and are appropriate for their circumstances.

Ontario is considering regulations for so-called high-cost credit products, which would include high-interest auto loans offered by independent lenders, according to Mr. Ha-Redeye. Currently, only British Columbia, Alberta, Manitoba and Quebec have legislation specifically devoted to high-cost credit.

Still, the fact that auto dealers often arrange financing on behalf of lenders creates regulatory and oversight gaps, Mr. Ha-Redeye said. Across Canada there are few standards and rules around how dealers, who are regulated provincially, place those loans, he said.

Ms. Hodgkin, for her part, hasn’t had an auto loan since filing for bankruptcy in 2020. Instead, just before surrendering the Kia Optima, she bought a 2002 Honda CRV in a private sale for $500 cash. When that car started needing expensive repairs, she found another vehicle of the same make and model year, for which she also paid $500.

Now if something breaks in her current Honda, she can tap her older CRV for spare parts to keep the new one running.

“I’ve got a parts vehicle,” she said. “It’s great.”

Are you a young Canadian with money on your mind? To set yourself up for success and steer clear of costly mistakes, listen to our award-winning Stress Test podcast.

Be smart with your money. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Sign up today.