Alliance Q1 earnings – exceptional contract pricing to drive 2022 earnings beats

[ad_1]

ANGHI/iStock via Getty Images

Alliance Resource Partners (ARLP) pre-announced details of Q1 results Tuesday. The company also lifted the dividend 40%, flagged supply chain issues during the quarter, detailed royalty-related tax changes, and increased full-year guidance. Increased contract pricing guidance could surprise markets.

The company expects Q1 net income per share to come in between 27c – 28c, versus Street expectations of 60c. However, the results reflect a one-time non-cash deferred income tax expense related to royalty changes of 29c per share, and a one-time cash tax expense of 5c per share. Adding back these non-recurring tax expenses results in “adjusted” earnings per share of 61c. Adding back a 21c impact from supply chain headwinds, which the company expects to offset later in the year, adjusted earnings for Q1 came in at 83c per share.

The release detailed a series of supply-chain related issues which impacted sales in the quarter. Seasonal barge lock maintenance, high river levels and rail transportation challenges all impacted the Company’s ability to ship. In total, Alliance (ARLP) was unable to ship 1.1mt of contracted volume in the quarter. These headwinds reduced earnings by 21c per share, though the company expects to make up the volumes later in 2022.

Not only does Alliance (ARLP) expect to make up for lost tons during Q1, management raised annual sales volume guidance by ~1%. The company also indicated oil, gas and coal royalty profitability will exceed prior estimates. However, the coal pricing guidance changes were dramatic.

At year-end, Alliance (ARLP) had committed and priced 32.1mt for 2022. As of Tuesday’s release, the company had committed and priced 34.2mt. However the additional 2.1mt led to a full $11.3 / 24% increase in the average revenue per ton for all of 2022 committed volumes. The math would indicate that the incremental 2.1mt of committed sales were contracted at over $230 per ton, suggesting Alliance (ARLP) is successfully exporting thermal to the seaborn market. Adding $11.3 dollars per ton to company’s 34.2mt of contracted volume, leads to EBITDA improvement of ~$386m, or ~$3.00 of incremental EPS.

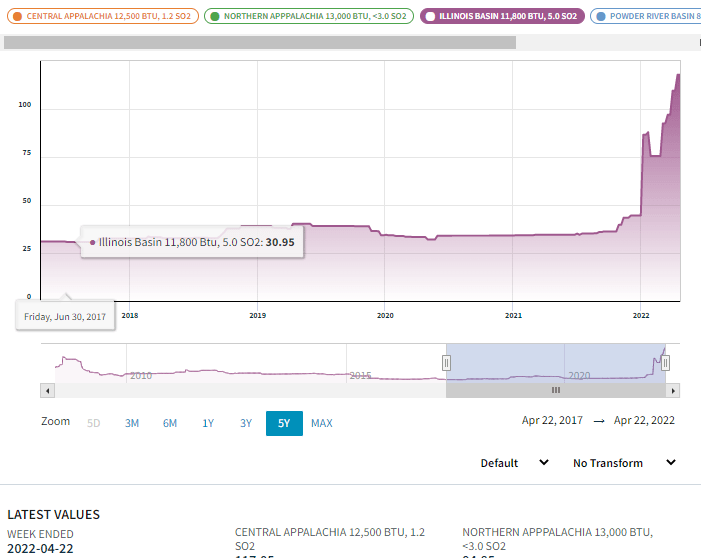

In addition to generating incremental earnings, successfully exporting thermal coal out of Illinois is likely to lead to improved in-basin pricing for 2023 contracts. And that is exactly what weekly spot market data suggests is happening:

Ahead of Q1 earnings, coal investors were looking for management teams to maximize profitability and capture long-term value from dislocated energy markets. Arch (ARCH) reported earlier Tuesday and made the case for higher multiples across the sector. Despite Q1 operational challenges, Alliance (ARLP) looks to have captured significant value through high-priced export contracts, while further improving in-basin supply / demand dynamics to drive cash flow and shareholder returns well into 2023. With Peabody (BTU) CONSOL (CEIX) and others on deck, coal investors are sure to be focused on management commentary around pricing and demand dynamics.

[ad_2]

Source link